If you want to get a loan without ATM Card required, you might want to take a deep look into the list of loan apps that gives instant loan without ATM Card or Collateral in Nigeria. Please do ensure to read their terms and conditions before accepting a loan from them.

Here Dosuggest has hand-picked some Loan App that gives instant loan without ATM Card details needed if you want to get more finance and loan update like this. please subscribe to our youtube channel for free and join our Telegram channel.

What is A Loan

A loan is the transfer of money by one party to another with an agreement to pay it back. the borrower incurs a debt and is usually required to pay interest for the use of the money.

There are different types of loans and levels of verification to be given such loans from any Loan firm/app. here are some common types of loans that you can find and get from Loan apps or Banks.

Why Loan App Ask For ATM Card

Your debit card is used to debit you automatically when the loan is due for repayment, most people do forget to repay the loan or default when it is time for repayment of the loan. As a way for these loan apps to get back their loan + interest, you have to provide debit or credit card details.

However, not every loan app will need your ATM card to give you a loan, depending on the purpose of the loan.

So, let’s look at the types of loans and requirements to get the loan.

Types Of Loans

Most loans require can be gotten with little or no requirements, depending on the loan lender, here are the reasons and types of loans you can get fast (instantly).

- Auto Loan.

- Business Loan.

- Mortgage Loan.

- Student Loan.

- Personal Loan.

Briefly, we will explain what are the types of loans and afterwards give you a whole list of where to get loans without collateral and trusted loan apps in Nigeria.

Auto Loan

The type of loan you get to purchase a vehicle, automobile and parts is known as Auto Loan and not all loan apps or bank do cover this, which gives such a loan. where you can get Auto loans from are from firms like Autocheck and others which we will discuss in the subsequent Loan Update series here in Dosuggest.

Business Loan

The aim of starting a business is to make a profit and any business that makes a good profit can pay any loan interest. So, there are lots of banks and loan apps in Nigeria that are ready to give you a business loan without ATM card provided you submit your business registration certificate and documents. If you want to get a loan as a handyman, you should consider registering your services with CAC in Nigeria.

Mortgage Loan

A mortgage is also known as a house, home property or landed property, there are some much benefit to a mortgage loan because the landed property accumulates value over time and enable you to pay back later if you optimize the use very well.

However, even if you can get this loan without an ATM card needed, you will need to provide other documents and collateral to get access to the loan.

Student Loan

Student Loan is the lowest interest loan and is limited to setting amount but depending on the purpose for the use, some student can take a loan to start a side hustle business while some can take a loan to travel abroad for higher education.

If you are interested in how to get a loan to study abroad, follow our Loan Update Series here.

There are lots of student loan apps in Nigeria and you do not need an ATM Card to get a loan from them.

Personal loan

If you are not a student or your purpose is not among the above types of loan, then maybe you have emergency bills you want to settle like medical bills or personal use needs. there are loan apps you can get personal loans without ATM Card details and how to pay them back.

Personal loans allow you to borrow instant loans to solve your personal problem and use them, this kind of loan ranges from as loan as (1k) 1,000 naira to 500,000 naira (500k).

But please, try to avoid these fake loan apps mentioned in this video.

Now we know the types of loans we can get, how about we see which loan apps can give you such loans instantly?

List of Loan Apps Without ATM Cards Required in Nigeria

There are lots of loan apps that can give you a set amount of loan without an ATM card, ID card, BVN or face selfie. but, this depends on the level and amount you need. the higher the loan, the higher the verification.

Here are Dosuggest list of Loan App without ATM cards or BVN;

- Aella Credit Loan App.

- Branch Loan App.

- FairMoney Loan App.

- Palmpay (Flexi Cash) Loan App.

- RenMoney Loan App.

- Okash Loan App.

- Umba Loan App.

- EaseMoni Loan App.

We might update this list as we discover new loan apps if you have anyone that might be helpful and legit. do leave a comment.

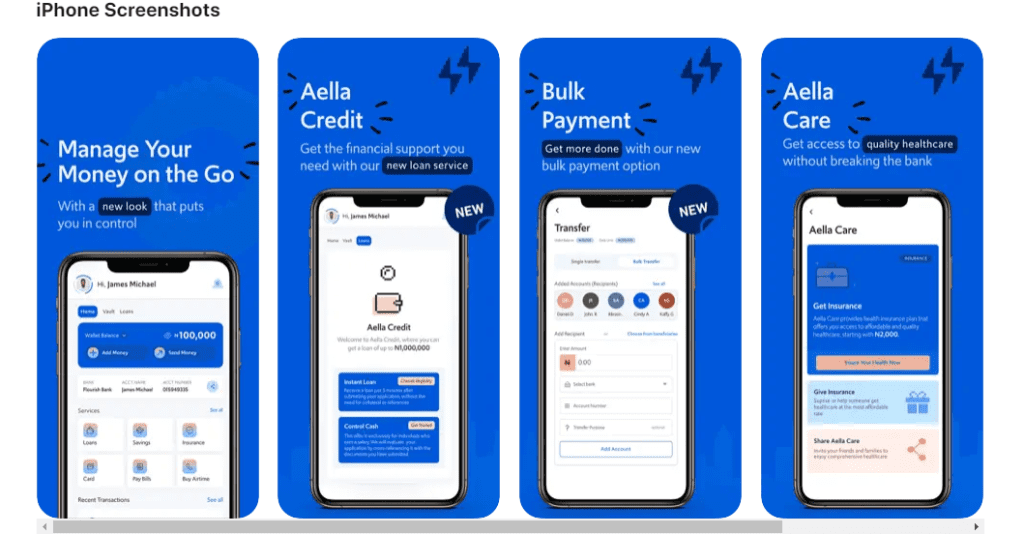

Aella Credit Loan App

If want to borrow from Aella for the first time, you have to download the Aella App from Apple App Store or Google Play Store. Install and create a new account, filling in all necessary required documents for the first time.

Aella Credit Loan App is among the top digital loan app in Nigeria, with over 1M+ downloads on Google Play Store.

You can download the app from here

Click Here To Download From Apple App Store

Click Here To Download fromGoogle Play Store

Aella is a fintech company built to simplify instant credit and payment solutions for emerging markets. At Aella, they have designed products that build financial independence for their customers such as loans, investments, bill payments, micro-insurance plans, and money transfers. All of these at the snap of your fingers.

The Aella app is duly registered as the name Aella Credit Limited on the CAC portal, also approved by CBN.

| Interest rate: | 4% – 29% |

|---|---|

| Loan term: | 30 to 60 days |

| Loan available: | Up to ₦90, 000 |

| Repayment: | In-app with debit card, Quickteller, and others |

| Collateral: | No collateral required |

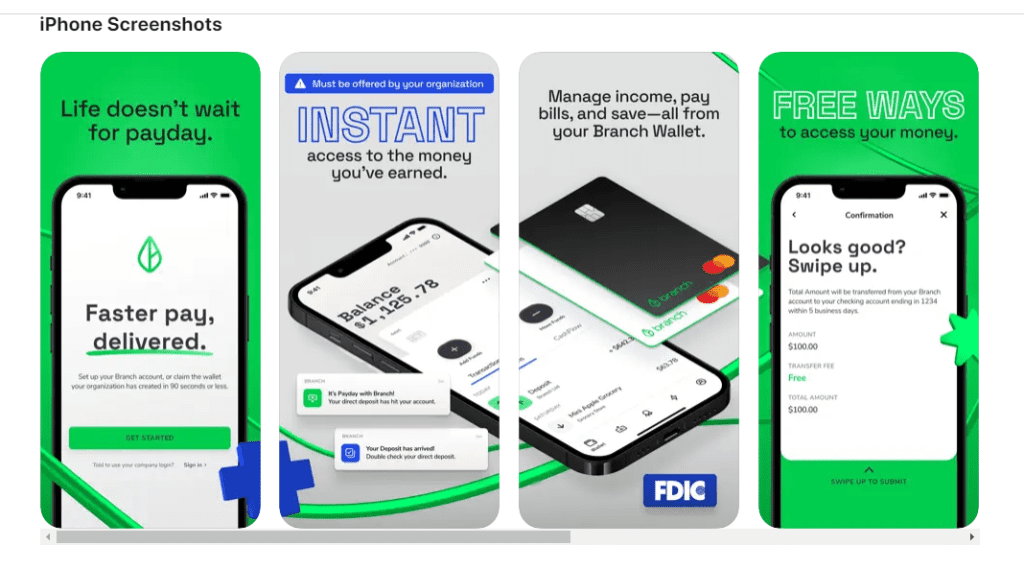

Branch Loan App

The branch offers loans from ₦2,000 to ₦500,000. Loan terms range from 9 – 52 weeks. Interest ranges from 17% – 40% with an equivalent monthly interest of 1.5% – 15% and APR of 18% – 260%, depending on your loan option.

There is no collateral necessary. Interest rates are determined by a number of factors, including your repayment history and the cost of lending for the Branch. Standard SMS and data charges by your mobile carrier may apply.

You can download the branch app from your App Store,

Click Here to Download from Apple App Store (iOS)

Click here to Download From Google PlayStore (Andriod)

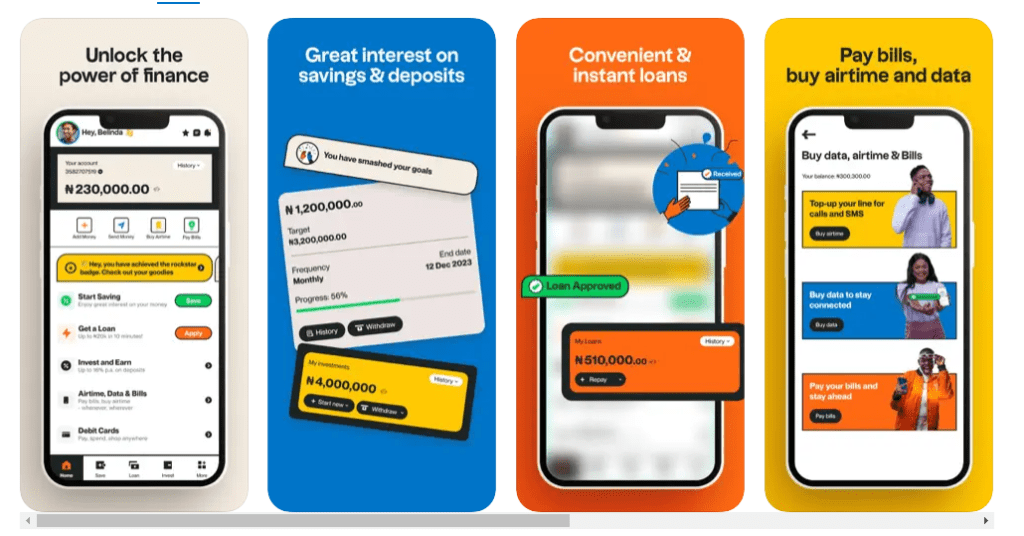

FairMoney Loan App

FairMoney Loan App is rated as the top best Loan App in Nigeria, with fair interest rates and a convenient repayment policy. this is the popular instant loan app available on Android devices only, not yet for iPhone users for privacy and policy sake.

That is you can only use FairMoney App on Andriod and the web only at fairmoney.io

On Google Playstore alone, the Fairmoney loan app has over 10M+ downloads making it the leading loan app in Nigeria.

Click Here To Download From Google Playstore

with Annual interest rates ranging from 12% to 36% per annum

Quick disbursal in under 5 minutes, without collateral or paperwork and delivered directly to your bank account.

You can get a loan without ATM card from the Fairmoney app.

Palmpay Loan App

At the mention of PalmPay, Nigerians will laugh because of how the media has presented it to be which is not.

Here is a short explanation of how PalmPay Loan (Flexi Cash) works;

PalmPay is an intuitive financial app with account opening, money transfer, and bill payments in one. PalmPay is worthy of your trust based on its safety and reliability. And it is fully licensed and regulated as a Mobile Money Operator by the Central Bank of Nigeria, insured by the NDIC, and trusted by millions of users.

With over 500 cooperation partners, PalmPay supports all scenarios you want to pay. Only your phone number is needed to complete the registration. And you can get benefits in PalmPay APP, including amazing coupons for newbies, free transfer chances, cashback or discount on every transaction, etc. If you recommend new users to PalmPay, you can get extra amazing invitation rewards such as N2,500 real cash.

After FairMoney, Palmpay is the #2 top-rated Fintech app in Nigeria on Google Playstore with over 10M+ downloads.

Palmpay is available on both iPhone devices and Android from various app stores.

Click Here to Download Palmpay from Apple App Store (For Iphone)

Click here to Download Palmpay from Google Playstore (for Android)

RenMoney Loan App

With RenMoney you can get a quick loan in just a few steps. loans are for people who are employed, self-employed or business owners. So, if you need an instant personal or business loan, you can borrow from ₦6,000 to ₦6,000,000 and repay in 3 – 24 months.

The Renmoney app gives you instant access to quick loans, savings and investments with competitive interest rates.

- Lower rates and longer tenure on your next loan

- No paperwork

- No collateral or guarantor needed

- No hidden charges – you always see your loan terms before you commit

To get started with a Renmoney loan, simply download and install the RenMoney loan app from App Store

Click here to download from Apple App store

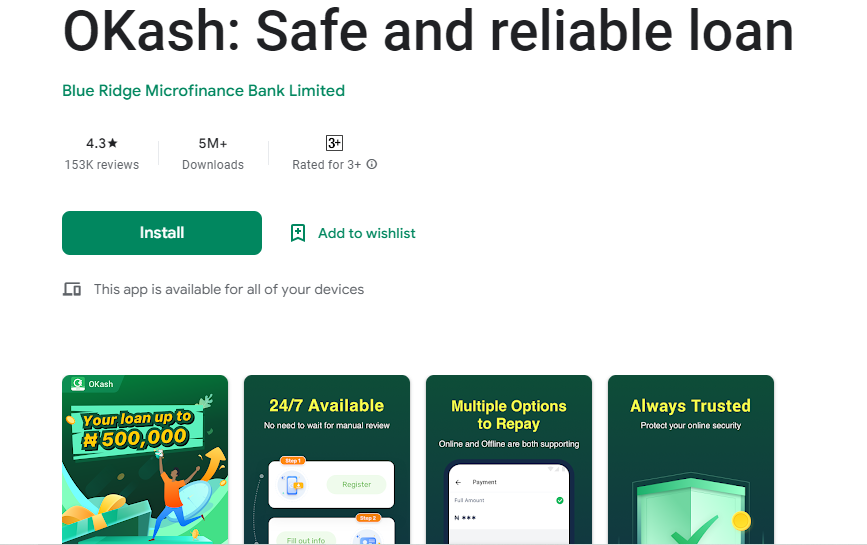

Okash Loan App

Okash is a good loan app if you’re looking for a means to offset your bills, fund a business or solve pressing needs without having to pay high-interest rates or submit collateral like traditional bank loans. It’s totally worth getting a loan through Okash as they’re one of the best online loan apps in Nigeria. Simply apply for a loan and if accepted you get a loan of up to N500,000.

This app is under the license of Opay or you can say Okash by Opay, in most device you can find it inside opay app while on android device it is a stand alone app.

If you want to know how to borrow loan from Opay, Okash is the method to apply for loan and get it via your Okash wallet.

Click here to Download Okash App on Google Playstore

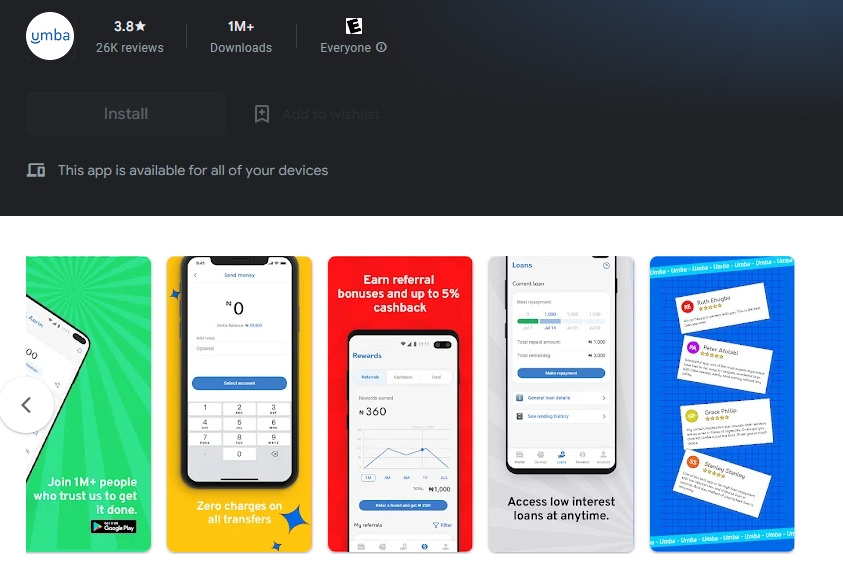

Umba Loan App

Umba provides you with the best banking experience when you want financial services. That it is zero balance account opening, unlimited free transfers, smart & affordable loans and up to 3% cashback on every bill pay and airtime purchase. When we say we got you, we meant it. Switch to Umba today!

Get Umba Loan App in 2 Easy Steps

1. Download the app and open an account

2. Fund your account and start transacting to earn rewards

Download Now from your trusted app store of your device, this app is available on all devices.

With over 1M+ downloads on Google Playstore

Download from Google Playstore

Nigeria Market Requirements:

– Download the Umba app from the app store to install on your phone

– Follow the step-by-step prompt to get registered

– Verify your identity – Valid ID (Driver’s license, International passport, Voter’s or National ID card)

– Supply basis requirements – Utility Bill, BVN/NIN

– Fund your Umba account via a debit card or transfer money from another bank.

EaseMoni Loan App

Easemoni is an instant personal cash loan app in Nigeria, with a microfinance banking license from the Central Bank of Nigeria. In the last 6 months, millions of customers keep lending money from them.

No collateral, borrow money online anytime and anywhere from the EaseMoni Loan App now

From our research, EaseMoni Loan app is only available for Andriod user only.

Click here to download from Google Playstore

In conclusion, we have shown you the types of Loans and requirements needed and which do not need you to provide an ATM card, ID card or BVN to get a loan from them. As we explained, depending on your loan history you might be asked certain information and delay to fully verify your account before you can get a loan for the first time.

If your loan history is clear, you can get an instant loan in minutes without collateral or BVN requirements.

Join Our Telegram Channel for updates like this.